The Quantum Boom: M&A and Fundraising Frenzy in H1 2025

The quantum sector just experienced the most dramatic six months in its history, with over $2.7 billion raised and significant M&A deals.

The recent flurry of capital activity in the quantum industry is reshaping the competitive landscape, which has important implications for investors, entrepreneurs, and the future of quantum technology.

The first half of 2025 will be remembered as the moment quantum computing truly arrived. While I’ve been tracking this space for years, watching incremental progress in qubits and fidelity, the sheer scale of capital deployment and strategic activity over the past six months represents a fundamental shift. This isn't just about research anymore—it's about building businesses that will define the next generation of computing.

M&A Activity: The Onset of the Great Quantum Consolidation

The M&A landscape tells a story of aggressive consolidation, with IonQ emerging as the sector's most strategic acquirer. What we're seeing isn't random deal-making—it's the deliberate construction of integrated quantum ecosystems. Here’s a table of the major quantum M&A transactions closed during the first six months of 2025:

[1] Stock merger, based on 12,377,433 shares of IonQ issued as of May 30 when the stock was valued at $49.97

IonQ's Billion-Dollar Bet: IonQ's $1.075 billion acquisition of Oxford Ionics is a deal that immediately caught my attention for its sheer scale and significance. Oxford Ionics wasn't just another quantum computing startup; they brought world-record qubit fidelity and, more importantly, the ability to manufacture quantum chips using standard semiconductor processes. This manufacturing scalability represents the holy grail of quantum computing: moving from laboratory curiosities to production-ready systems.

The earlier acquisitions in IonQ's spree were equally strategic. The $250 million ID Quantique deal brought nearly 300 patents and quantum encryption capabilities, while the $22 million Qubitekk deal added quantum networking. Lightsynq brought Harvard-bred expertise in quantum memory and photonic interconnects (vital to network qubits, which is especially important for ion-based systems), and that valuation is jaw-dropping especially in light of their small staff (a handful of employees) and modest prior financing ($18 million). IonQ is building something unprecedented: a vertically integrated quantum technology stack spanning computing, networking, security, and manufacturing.

The Ecosystem Play: What fascinates me about these deals is how they reflect a fundamental shift in quantum strategy. The days of pure-play quantum computing companies are ending. Winners will own entire quantum ecosystems—the hardware, software, networking, and security layers that make quantum computing commercially viable. IonQ's acquisition spree exemplifies this trend, but I expect we'll see similar consolidation patterns from other major players.

Fundraising Explosion: $2.7+ Billion in Six Months

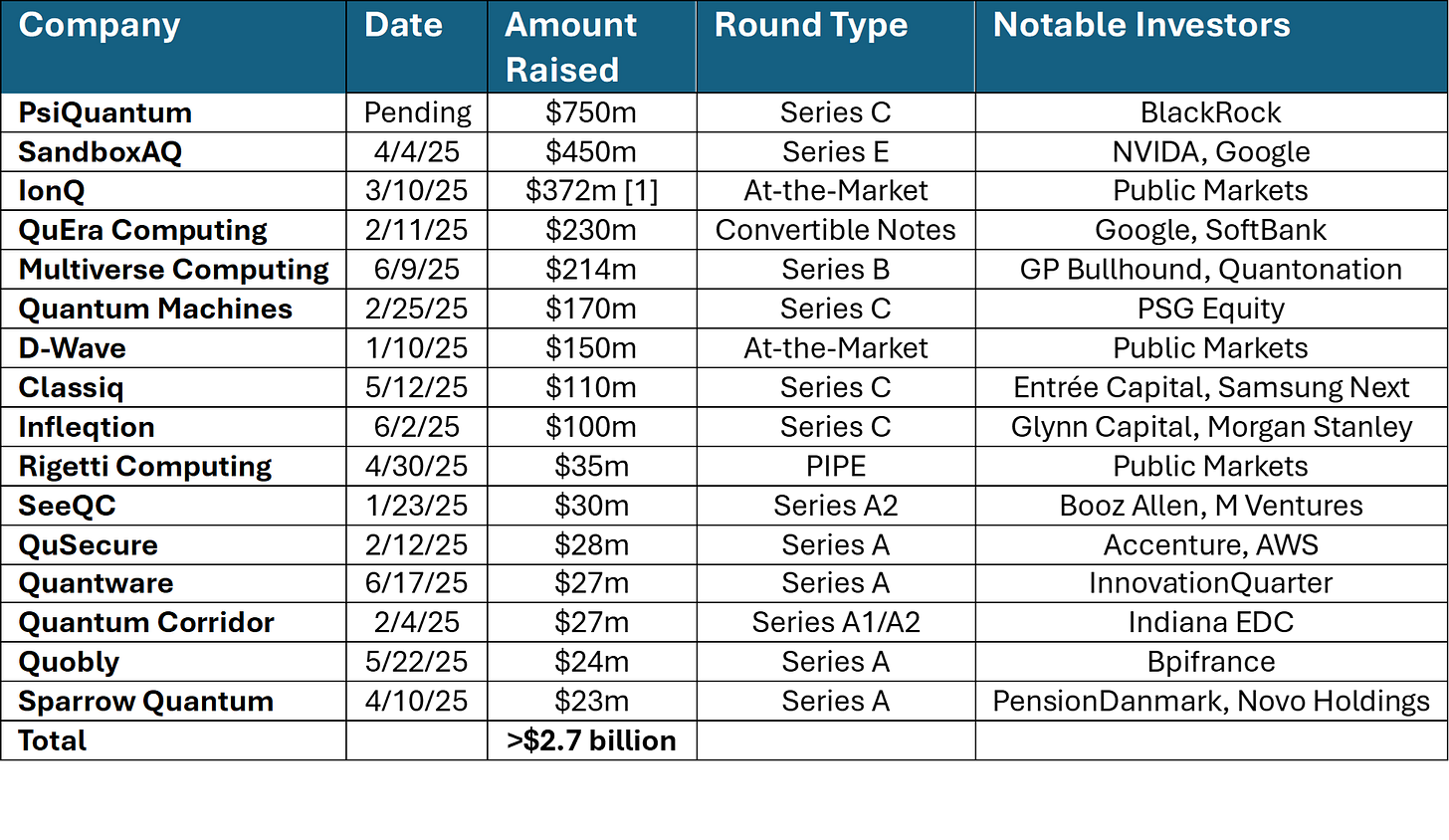

The fundraising numbers are staggering, even by Silicon Valley standards. We're talking about $2.7 billion deployed across just 16 major rounds—a level of capital commitment that signals genuine institutional confidence in quantum commercialization. And this excludes the additional $1 billion invested by Hights Capital Management into IonQ earlier this week at a 25% premium to the trading price. The following table highlights quantum equity rounds greater than $20 million during the first half of this year:

[1] Excludes $1.0 billion Heights Capital Management investment in early July

The Billion-Dollar Club: IonQ's $1.0 billion raise from Heights Capital Management was the defining moment in quantum capital formation so far this year. This wasn't just fundraising—it was a statement about quantum computing's commercial viability. When a sophisticated institutional investor like Heights Capital deploys $1 billion in a single quantum bet, we should all take notice.

PsiQuantum's $750 million Series C, led by BlackRock, further validated the sector's momentum. PsiQuantum's photonic approach represents a fundamentally different technological bet than IonQ's trapped ions, but BlackRock's continued leadership (they led the previous round too) suggests strong conviction in the company's silicon photonics strategy. There is substantial skepticism about photonic qubits and PsiQuantum’s renowned secrecy doesn’t do anything to allay those feelings. Given the $1.3 billion they have raised to-date, and their recent $3.15 billion valuation, I’m hoping they are successful because if they are not, it would be a devastating failure and would roil quantum investment markets.

Public Market Validation: The success of IonQ’s $372 million, D-Wave's $150 million and Rigetti's $35 million at-the-market offerings, plus the pending $500 million Horizon Quantum’s SPAC merger demonstrates that public markets are beginning to embrace quantum companies. D-Wave's shares traded at a 149% premium to previous offerings, while all of these companies now sit on substantial cash war chests to fund their scaling ambitions.

Software and Infrastructure: Classiq's $110 million Series C was particularly noteworthy as the largest quantum software funding round ever. The company's vision of becoming "the Microsoft of quantum computing" resonates with enterprise customers like BMW, Citi, and Rolls-Royce. Their tripling of revenue and customer base validates the market's hunger for quantum development tools.

Strategic Alignment: QuEra's $230 million convertible note, with participation from Google's Quantum AI division, signals strategic alignment between hardware and software approaches, and SandboxAQ’s investment from NVIDA and Google is another example of such alignment.

What This All Means

The quantum sector's H1 2025 performance represents more than just impressive fundraising numbers—it's evidence of a fundamental market transition. We're witnessing the evolution from pure research to commercial application, from laboratory demonstrations to production deployments.

The Commercialization Inflection Point: Companies like D-Wave, QuEra, and Infleqtion are generating real revenue, not just burning through research grants. D-Wave's 500% year-over-year revenue growth and QuEra's $41 million system sale to Japan demonstrate that quantum computers are becoming products, not just research tools.

Technology Diversification: The funding spans every major quantum computing approach—trapped ions, photonics, neutral atoms, superconducting qubits, and silicon quantum dots. This suggests we're still in the early stages of technological development, with multiple paths to quantum advantage remaining viable.

Strategic Corporate Engagement: The participation of Google, NVIDIA, IBM, and other tech giants as both investors and strategic partners indicates that quantum computing has moved from "interesting research" to "strategic imperative." These companies aren't just making financial investments—they're building quantum capabilities into their core technology stacks.

Global Competition: The geographical distribution of funded companies—from California to Tel Aviv to Sydney—reflects the global nature of quantum competition. No single country or region dominates, suggesting that quantum leadership remains up for grabs.

The Infrastructure Layer: Perhaps most importantly, significant capital is flowing to quantum software, control systems, and error correction companies. This infrastructure investment is crucial for quantum scaling and indicates that the sector is maturing beyond pure hardware development.

Looking ahead, I expect the consolidation trend to accelerate. The quantum sector is still fragmented across dozens of companies pursuing different technological approaches, but the capital deployment we've seen in H1 2025 is creating clear winners with the resources to dominate their respective niches.

The companies that successfully navigate this transition—building integrated quantum ecosystems while maintaining technological leadership—will define the next generation of computing. Based on H1 2025's activity, that future is arriving faster than anyone expected.

The quantum revolution isn't coming—it's here. The question now is which companies will lead it.

References:

Transactions and valuations included in this post sourced from PitchBook Data, Inc. and Perplexity